Optimizar al máximo un tóner para ahorrar en cada impresión Si se comparan las impresiones de hace un par de lustros con

More¿Estás listo para el lujo y la exclusividad en la Costa del Sol? Descubre los Mejores Hoteles y Villas de Lujo en

MoreEl Lujo que Revoluciona los Mares se llama MSC Explora Journeys, y los veremos en Málaga… ¿Podría Málaga Convertirse en el Nuevo

More¿Puede el Hotel Lima Revolucionar la Cultura en Marbella? ¡Descúbrelo! Descubre cómo el Hotel Lima está transformando Marbella en un núcleo cultural

MoreCOMPRAR PAPEL PINTADO ONLINE – No en todos los casos tenemos la posibilidad de adquirir todo lo que nos gustaría y tener

MoreTerrazas, la nueva forma de socialización y disfrute En las últimas décadas, el auge de los bares con terraza ha transformado el

More¿Está Estepona en la cúspide de un renacimiento turístico gracias a la inversión emiratí? 🌟 ¡Descubre cómo Estepona se transforma con un

MoreLa Peruta – Saenz Quartet: Fusión y Talento en el Clarence Jazz Club La Formación de un Cuarteto Único El cuarteto La

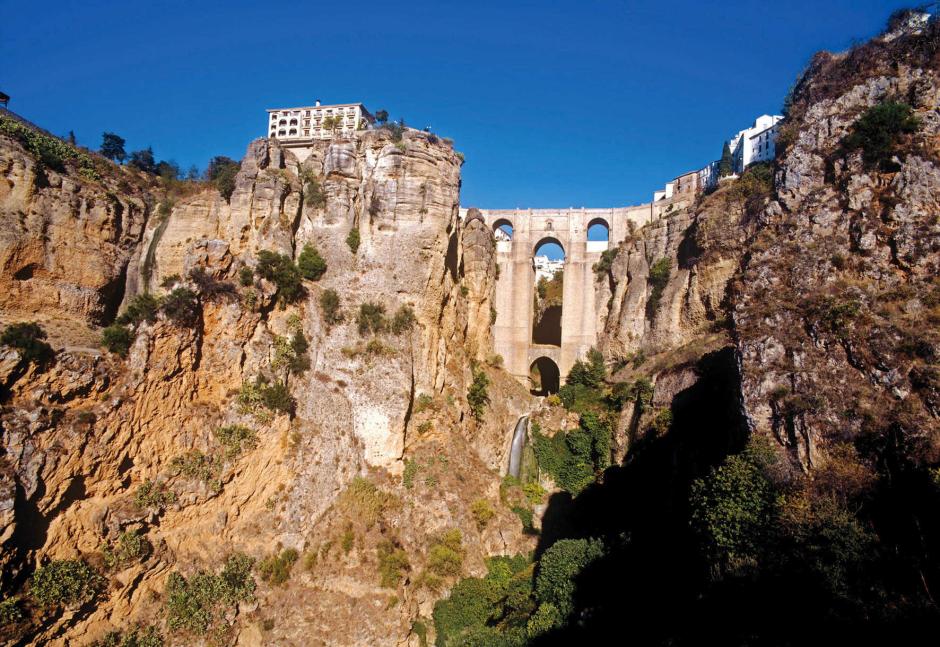

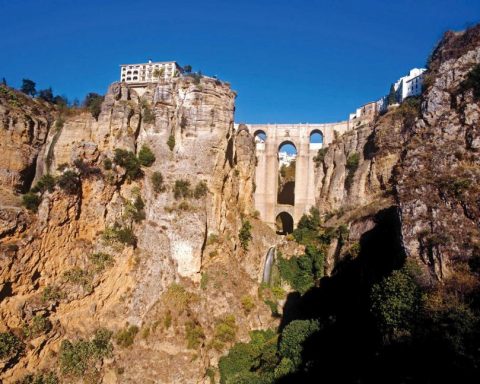

More¿Cómo los Hoteles de Lujo Revitalizan el Patrimonio de Ronda? 🌟 Explorando Ronda: Hoteles de Lujo en Edificios Históricos y el Nuevo

More¿Cuál será el futuro del turismo de lujo en Ronda con el nuevo hotel de The Meliá Collection? 🏨 Descubre el nuevo

More¿Estás listo para la aventura de las subastas de trasteros al estilo americano en Málaga? 🎉 Vive la emoción de las subastas

More¿Podrán los Málaga Tech Games unir aún más a la comunidad tecnológica global? ¡Descubre los Málaga Tech Games 2024! Innovación y deporte

MoreExplorando Málaga desde Todos los Ángulos: Una Inmersión Virtual con “Málaga 360”. Málaga 360 – Descubre los Encantos de la Costa del

MoreSi precisas de un despacho de Abogados Penalistas atiende pues voy a recomendarte a unos de los mejores que, a mi juicio, puedes encontrar

MoreEmbarcaciones de recreo, el nuevo plan en la Costa del Sol Navegar en barco por la Costa del Sol es una experiencia

More¿Cómo Amorino Marbella conquista corazones con su helado artesanal? Descubre la magia detrás del gelato de Amorino Marbella: arte, sabor y tradición

Moremejores restaurantes marbella: Restaurante DOM Utilizan exclusivamente ingredientes de origen local y con certificación de calidad La esencia de la “Cocina de

MoreEl reto de conseguir la vivienda perfecta en la Costa del Sol La demanda de viviendas en la Costa del Sol lleva

More¡Goles y Glamour! El nuevo estadio de Marbella, un sueño futbolístico cerca del Mediterráneo. Nuevo Estadio de Marbella: Inversión Millonaria y Futuro

More¿Cómo una antigua embarcación malagueña surca las olas del tiempo hacia el futuro? 🚣♂️ Descubre el fascinante mundo de las Barcas de Jábega

More¡Viaje en el Tiempo Cinematográfico! Andalucía Desvela Joyas Fílmicas Taurinas 🎬✨Descubre la Historia Taurina de Andalucía a Través del Cine🐂💫 La riqueza

MoreDescubre el Reino del Confort: Un Viaje Sensorial por VITTELLO Málaga 🌟: Descanso y Diseño Exclusivo ✨” En la búsqueda de sofás

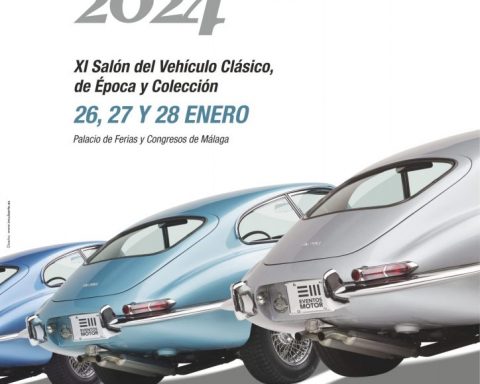

MoreCuando el Pasado Acelera en el Presente: El Espectáculo de Retro Málaga 🚗💨 Retro Málaga 2024: Vehículos Clásicos, Cadillac Eldorado, Jaguar, Tatra

MoreUn Viaje Sensorial: Descubre el Encanto Polifacético de “La Polivalente” 🎭🎨 Micro abierto de poesía y música, Artes Escénicas, Teatro, Danza, Performances,

More¡Noches de Jazz Sin Fin! La Increíble Historia de Clarence Jazz Club 🎷🌟 Descubre la Magia del Clarence Jazz Club en Málaga

More¡Futurismo en Acción! La Investigación Biomédica de Málaga Desafía el Presente 🔬Investigación Biomédica en Málaga🧬: Futurismo Realizado en el PTA🌟 En la

MoreEl Weekend Beach Festival Torre del Mar: Un Épico Encuentro Musical 🎵🌴 Weekend Beach Festival Torre del Mar 2024: Cartel, Artistas y

MoreBono Beach Marbella: Reserva Tu Mesa o Cama en el Paraíso Mediterráneo Bono Beach Marbella – Una Experiencia Única En el corazón

MoreLuis Fonsi y Omar Montes: Una Colaboración “Marbellí” que Promete Romper Esquemas 🎶🌴 Luis Fonsi estrena “Marbella” junto a Omar Montes –

MoreMilbby abre su vigésima tienda en el P.C. Miramar en Mijas Milbby, la mayor cadena de tiendas de bellas artes y

MoreVuelos Directos y Exóticos: ¡Descubre las 136 Ciudades Conectadas con Málaga! 🌍✈️ Conexiones Directas y Destinos Exóticos 🏝️🌆 Desde el próximo 31

More¡Desvelando el Secreto del Éxito Inmobiliario en Málaga! 🏡🌞 – Venta de Chalets en Marbella 🌞🏡 En el corazón de la Costa

MoreEl Nacimiento de Misake: Cuando el Sushi Conquista Mijas – 🍣 Misake en Mijas – Fusión Asiática, Descuentos y Espectáculo 🐉 El

MoreLa Revolución del Hot Pot Llega a Málaga: Xiaolongkan Abre sus Puertas 🍲🎉 La Expansión Global de Xiaolongkan y su Aterrizaje en

More